As I've written many times before and will write about many times in the future, financial planning is all about making choices. Heck, that's all life is really.

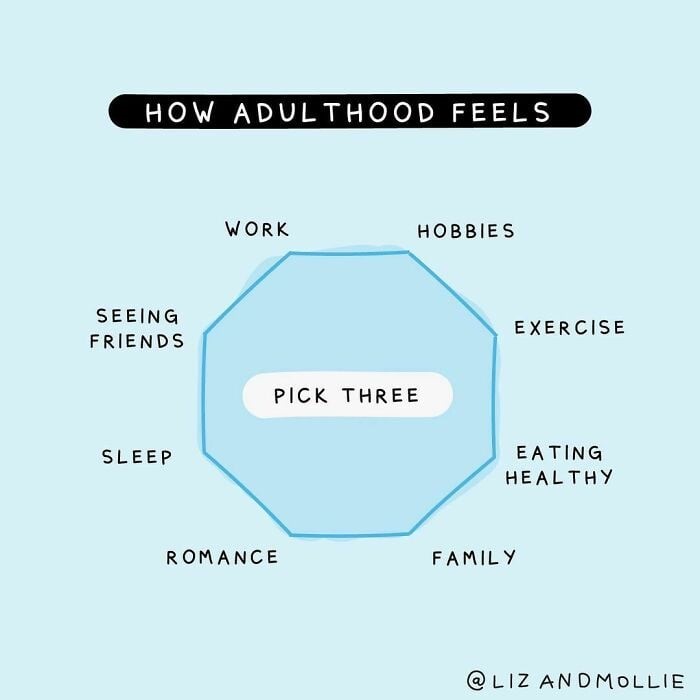

Time is a finite resource and we can't simply do ”everything” despite our best attempts to cram it all into our schedules. This graphic perfectly captures this idea of having to choose:

Some of you will elect to strike a balance between doing a little bit of a lot of different things in your life.

Some of you will elect to strike a balance between doing a little bit of a lot of different things in your life.

Others of you will - deliberately or not - focus on a few things at the expense of others. I don't have this figured out, so I'm not passing judgment of suggesting there's a wrong or right way to choose.

The same holds true for your financial and retirement planning...Making choices is not optional. Do you want to work 60+ hour work weeks for 30+ years to accumulate a pile of money only to find you've lost touch with your family, friends, and personal life in the process? Do you want to live it up today and worry about tomorrow... well, tomorrow? I think most aim to strike a balance somewhere in the middle.

But you still have to make choices along the way...

• How much are you saving vs spending?

• How much risk are you taking with your investments? And are you taking the risk you think you can tolerate or the minimum amount of risk necessary?

• Are you adequately insured, or are you OK accepting some additional risk in the event that something happens you didn't see coming?

• Even if you're living well today and preparing for tomorrow, are you waiting to live your life and do the things you really want to do only after you retire?

Are you going to spend your wealth with the ones you love during life or do you prefer to leave it to them after you are gone?

These are but a few of the myriad choices we all face every day with our money and our lives. And while money choices are important, they pale in comparison to figuring out how to get more "return on life." I personally wrestle with these same choices. All the time.

And here's the problem... we each get one shot at making the most of our one and only precious life.

There are no do-overs. This isn’t a video game or some virtual reality simulation despite what some say.

In the real world all choices have consequences of some degree. We are each faced with choices each day and often have no idea what the impact of our decisions will be for months, years, or decades. This applies to your relationship with your friends and family as well as your relationship with money. Some are paralyzed by these choices, so they refuse to make some decision and just float along in the direction they're already going. Others are prone to listen to the opinions of all of their friends resulting in a constant state of confusion. I think the better approach is to make the most informed decisions you can and get on with living. And that's what financial planning is all about.

Making decisions in the face of uncertainty where we rarely, if ever, have all the details is why planning done right is no longer optional. Financial planning- when done properly - is indispensable if one wants to live their BEST life and finish their course with no regrets.