OUR PROCESS- Tensional Integrity

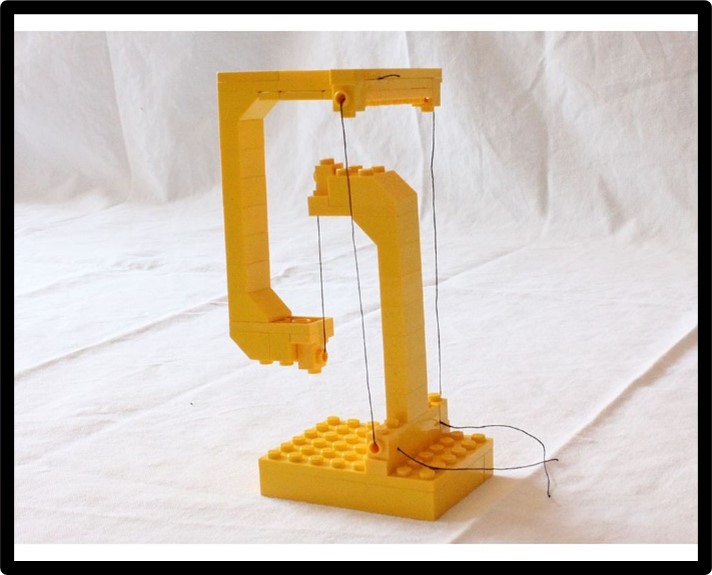

The term may not be familiar to most, but the concept is part of every-day life. Tensional Integrity is often shortened to simply TENSEGRITY and involves two forces- typically TENSION and COMPRESSION. The picture here is a “floating Lego structure I built using Legos and string. It is actually just a balance of TENSION and COMPRESSION that give it the appearance of levitating in mid air.

My friend and colleague Russ Thorton recently applied the principle of Tensional Integrity to Financial Planning.

Essentially, financial planning boils down to trade-offs:

• Spend today or save for tomorrow

• More investment risk vs less investment risk

• Retire sooner or later

• Give money to your family while you're alive or after your death

• Pay more in taxes today in an effort to pay less taxes down the road

• Pay down debt or invest

• And the list goes on and on.

And here's the thing.

These trade-offs create tension- both in our minds and in our lives. Furthermore, your personal decisions on some of the trade-offs listed above will be very different from those of your friends, your family, and your co-workers. And they should be different because they're yours, not theirs.

After nearly 40 years in this profession, I can almost guarantee that your perspective on these trade-offs today will most likely change over time. The dynamic between TENSION and COMPRESSION or the trade-offs mentioned above should not however lull you into making the mistake of thinking that the choice in life is EITHER THIS OR THAT. This is often referred to as the "black or white fallacy."

People do in fact seem to think - or want to believe - that financial decisions are always a simple either/or.

The reality is however that financial choices should really be considered as both/and decisions. For instance, rather than oversimplifying a decision like paying down debt OR investing, why not pay down debt AND invest.

Or spend today AND save for tomorrow. This is where I think the idea of tensegrity comes into play in the scope of financial planning. It's this tension between your present self and your future self that creates and maintains your financial plan. It gives your plan "structural integrity" and helps make it work. Or to parlay this into terms you have heard me use, TENSEGRITY in your financial plan allows you to live your BEST life. Think about it. Without achieving an equilibrium of trade-offs, you and everyone else would have the same financial plan – They would always…

- spend as little as you can

- save as much as you can

- work as long as you can

- take as much risk as you can

- etc...

Well, that's not a financial plan. At least not in my opinion. There's nothing personalized about it. And there are no benefits from regularly reviewing and adjusting it because there's nothing to adjust. And while it might lead you to a secure future, it will be at a great cost of your current lifestyle. We all are only given one chance at life. That’s a fact. You know what else is a fact? Nothing in life is guaranteed. Are you assured of tomorrow? Can you guarantee that you will still be alive next year? Or healthy? Etc?

Of course, the solution isn't the opposite extreme. You shouldn't live only for today at the cost of planning and preparing for the future. Again, it's about balance. And that balance comes from this idea of continuous tension between what you may want to do today vs what you need to do for tomorrow. And just like a table or a Lego structure that appears to be floating effortlessly in mid air because of TENSEGRITY, so also a properly balanced financial plan allows you to “float” through life in comfort and confidence.

.This is the future of Advice. This is planning done right!