ASSESSING THE VALUE OF ADVICE - REVISITED

ASSESSING THE VALUE OF ADVICE - REVISITED

Several years ago (approx.. 2014), Vanguard published groundbreaking research that quantified the value of advice. The study measured the benefit from such activities as costs, asset tax location, rebalancing, and the order of distributions, etc. According to their findings, following certain best practices resulted in approximately 3% more performance compared to not adopting those practices. The results were intuitive. An investor would experience better performance – 3% annually on average – by following certain best practices. Furthermore, all the recommended “best practices” could be performed directly by the investor without the assistance of a financial advisor. OK, you may be wondering about now – Wait? What? You are telling me what to do to boost my performance by 300 basis points and telling me that I can do everything on my own? How is that quantifying the value of advice? Great Question. Allow me to make an analogy to the weight loss industry. The process is VERY SIMPLE AND STRAIGHT FORWARD. Are you ready? Expend more calories than you take in. Do that and you’re virtually guaranteed to see the pounds drop off. It’s just that simple! But as we all know, what is simple may not necessarily be easy as evidenced by the fact that the weight loss industry generates in excess of $64 billion a year. Similarly, improving returns is virtually assured by following a few simple practices. And like weight loss, a few will do it on their own. The rest of us, however, need some help. And that my friends is the value of advice. It doesn’t matter how simple improving your performance could be if you don’t actually improve your performance.

That was then. This is now.

Vanguard’s follow up research released in September of 2019 turns the focus from objective actions that improve returns which by implication assigns value to an Advisor, to a more direct look at the esoteric emotional benefits derived from using an Advisor.

The latest research entitled “Assessing the value of advice” uses a three-part framework – Portfolio outcomes, Financial outcomes, and Emotional outcomes. The first two parts echo back to the quant research done in the earlier study. As a follow up study, Vanguard once again concluded that advice led to meaningful changes for most investors in both portfolio and financial outcomes. What was most intriguing in the current study was the third and final piece of their 3-part framework. In summary, a study of more than 500 Vanguard Personal Advisor Service (PAS) clients suggests that emotional outcomes account for 45% of total perceived value. By any metric, nearly 50% is significant.

As stated in the Vanguard study, “The third dimension of potential value relates to the investor’s financial well-being- the emotional security provided by the advisory relationship. Think of it as a subjective psychological measure of ‘financial happiness.’ Contributing factors include the investor’s sense of trust and confidence, feeling of accomplishment, and emotional connection with the advisor. Also included is the emotional support the advisor offers during periods of market volatility or other shocks to the household’s status, such as job loss, disability, or death.”

So, what emotional factors did Vanguard discover influenced an investor’s perception of value?

Over half (55%) of what investors perceive as being highly valuable fall under the category of RELATIONSHIP. Value propositions such as…

- Putting client needs first

- Continuously monitoring and updating a client’s plan

- Needing to feel a personal connection

- Access to expertise when needed

…were all areas investors highly esteemed in this category.

Another 28% of value come from statements the study described as “protection & Assurance”. This category includes investor statements such as…

- Needing to feel that they are on track to meet goals

- Knowing survivors will get the help they need navigating financial decisions

- Being reassured that everything will be okay even during less than pleasant times

- Knowing that they are protected against unexpected events

CONCLUSION:

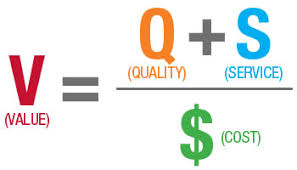

The three-pronged framework employed by Vanguard correlates closely to the formula for VALUE published by the University of Utah Health. As illustrated in this graphic, value is a component of three factors; Quality, Service, and Cost. Both Quality and Service in the numerator include emotions which is the focus of the 2019 Vanguard study. Vanguard found that emotional factors accounts for essentially half of all value a client perceives in their Advisor. Quantifying a subjective component such as emotions makes this study an important aid in helping an investor decide whether to go it alone or to get help and more importantly which advisor would be the best match for them.

The three-pronged framework employed by Vanguard correlates closely to the formula for VALUE published by the University of Utah Health. As illustrated in this graphic, value is a component of three factors; Quality, Service, and Cost. Both Quality and Service in the numerator include emotions which is the focus of the 2019 Vanguard study. Vanguard found that emotional factors accounts for essentially half of all value a client perceives in their Advisor. Quantifying a subjective component such as emotions makes this study an important aid in helping an investor decide whether to go it alone or to get help and more importantly which advisor would be the best match for them.

As a side bar, it is worth noting in the University of Utah Health formula above that cost is the sole denominator. As such, it reinforces our obsession with keeping costs low. The smaller the denominator, the greater value will be realized.

This is the future of Advice. This is planning done right!